Entrepreneurs operating in Gulf state hope that their delicate commercial links can withstand the conflict

Chloe Cornish and Andrew England in Dubai, Ivan Levingston in London, FT

In the days after Hamas’s October 7 attack and the war that followed, Israeli entrepreneur Ron Daniel left Dubai, his home since 2021, fearing that he was “sitting on a volcano”.

The chief executive of asset manager and financial technology company Liquidity Group flew back to the United Arab Emirates a month later after deciding these concerns were “mainly in my head”.

Daniel is among a small band of Israelis who have been living and working in the UAE since it normalised relations with Israel four years ago. His decision to return reflects hopes among Israeli businesspeople that the US-brokered normalisation with the UAE and three other Arab states — which allows them to openly seek deals in the Middle East — can withstand the fury and anguish created by Israel’s war in Gaza.

“The peace survived, the interest survived, the friendships survived,” said Daniel, adding that while it was “awkward” with Emirati friends at the start, “very quickly it was like, ‘it’s got nothing to do with us’.”

The UAE, like all other Arab states, has condemned the devastation wrought by Israel’s bombardment of Gaza, which has enraged Emiratis and a large part of the majority expatriate population.

But anger and hurt have largely been contained to private conversations in the autocratic state, where protests are prohibited. This has led to an absence of the kind of large scale demonstrations in support of the Palestinians seen across the region and other parts of the world. The authorities have also warned against overt displays of Palestinian solidarity.

The UAE’s leaders have stated their commitment to the deal with Israel known as the Abraham Accords, despite their concerns about Israel’s Gaza offensive.

“The UAE has taken a strategic decision, and strategic decisions are long-term,” presidential foreign affairs adviser Anwar Gargash told a conference in Dubai last month.

The UAE has long been unhappy with Prime Minister Benjamin Netanyahu’s far-right government. But it considers its decision to become the third Arab state to normalise ties with Israel as vital to its interests, both in terms of security and its economic ambitions.

The UAE needed to keep “communication, intelligence and diplomacy” channels open and see if it “can put them to use”, said Abdulkhaleq Abdulla, an Emirati analyst. “We knew there would be ups and downs.”

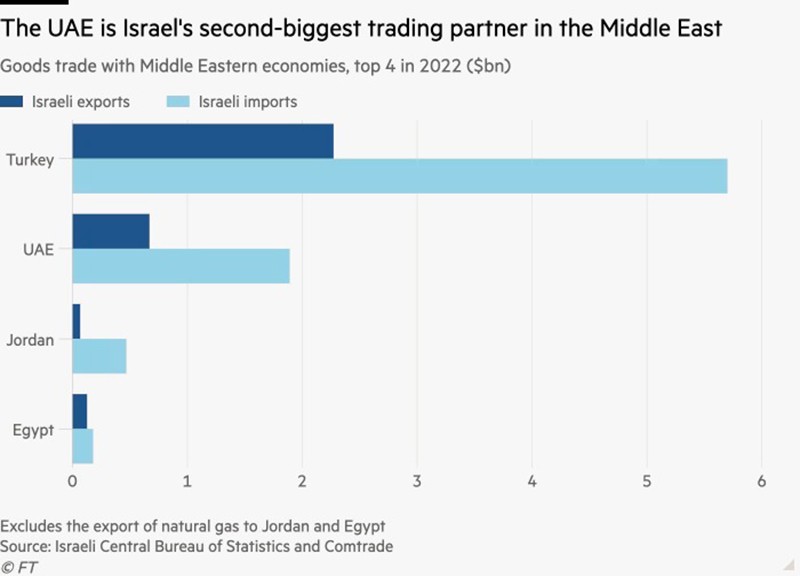

Unlike the “cold peace” that Egypt and Jordan agreed with Israel, the UAE — which never fought a war with the Jewish state — embraced the relationship and pushed for greater economic ties, with a particular desire to tap Israeli technology. And with the UAE and Israel sharing a foe in Iran, the accord also enabled Abu Dhabi to overtly develop intelligence sharing and security co-operation.

Most of the new business that followed the accord was conducted with Emirati state-affiliated entities, particularly those in Abu Dhabi, the oil-rich capital that drove the normalisation deal.

Even before the war, tapping private UAE family offices was harder than expected for Israeli entrepreneurs, who wanted to use the Abraham Accords to gain a regional foothold and access to deep-pocketed Gulf investors.

There was an idea that “Israeli entrepreneurs would come over, raise a lot of capital and come back”, said Elie Wurtman, co-founder of Jerusalem-based PICO Venture Partners. But “that is not the way business gets done there”.

The Israel-Hamas war has now chilled nascent prospects of Emirati private businesses doing deals with Israeli companies because of the simmering fury among merchant families — many of whom were already wary of dealing with Israelis — over the destruction in Gaza.

“Whether it’s business or socially, everyone who is here will think twice,” said an Emirati executive. “If I had business with an Israel company, I would stop that right now,” he added. “Emotions are very high.”

The most significant deals have involved Abu Dhabi’s state-affiliated companies. G42, Abu Dhabi’s artificial intelligence company chaired by Sheikh Tahnoon bin Zayed al-Nahyan, the UAE’s powerful national security adviser, was the first Emirati business to open an office in Israel. Abu Dhabi state fund Mubadala has invested $1bn in an Israeli gasfield and $100mn in Israeli venture capital and start-ups.

And even if some business may have slowed, there are signs that in other areas it is moving ahead.

Israel-based senior researcher Yoelle Maarek said last month that she was moving ahead with opening a Haifa branch of Abu Dhabi’s Technology Innovation Institute, renowned for its open-source large language model Falcon. TII said it had established itself in Israel early last year, and that Maarek “was in a recruitment process with us since late summer of 2023” — prior to the war’s outset — and has now been “onboarded”.

The Gulf state’s airlines have continued services to Tel Aviv even as other carriers cancelled flights, underscoring the interest in maintaining the relationship with Israel.

For many Israelis doing business in the Emirates, the Israel-Hamas war has sharpened the need for friends in a hostile region.

“Since October 7, perhaps the Abrahamic Accords is no longer in its honeymoon phase — but it’s still our future,” said Noa Gastfreund, co-founder of the Israeli-Emirati business forum UAE-IL Tech zone. The group is being rebranded as simply Tech Zone “in light of the sensitivities and need for wider regional collaborations”.

Arik Shtilman, chief executive officer of the Israeli-founded financial technology company Rapyd, which has about 100 employees in the UAE, said the war’s impact on his business was “literally nonexistent”.

“Everything is business as usual” in the UAE, he said, adding that there has been a greater change in Europe where it has become more challenging to sign on new clients.

The bilateral flow of goods between Israel and the UAE, excluding software, topped $2bn from January to August 2023, according to Israel’s ambassador in Abu Dhabi. A UAE-Israel partnership deal came into force last year, lowering tariffs and aiming to boost bilateral trade to $10bn within five years.

Wurtman of PICO Venture Partners said a crucial aspect was that Israelis still felt welcomed in the Gulf state. “It’s one of the safest places in the world today to be Israeli,” he said.